Giving everyone a voice: How technology is helping stakeholders better manage social and governance issues

Welcome to issue #4 of Base10: Automation for the Real Economy. Similar to our Forbes articles, each issue will explore our insights into a trend that is automating a Real Economy industry, as well as highlight companies that are building solutions to real world problems affecting the 99%. Today, Rexhi Dollaku discusses our research and insights into the social and governance technology trend.

Tyler is blindsided by the email staring back at him from his inbox. As the CEO of a fast-growing advertising agency, he’s been quite pleased with the company’s overall performance recently. This unnerving email, however, is from one of his top account managers. He schedules a quick sync with her where she expresses concern that she’s getting paid less than her male counterparts.

Tyler and his co-founder immediately get to work figuring out if his employee’s feedback is true. He goes to his People team to get some company-wide salary data and as he looks at the employee compensation report, Tyler begins to worry that that could be just the surface of a systemic problem at his company. He’s seen press from other companies and worried about how a problem like this will impact employee morale, squeeze their hiring pipeline, and reflect poorly on the company’s brand at large.

Thousands of CEOs just like Tyler routinely find themselves in a similar predicament and wish they had mechanisms in place to identify issues like unequal compensation immediately, before it has any impact on morale or culture. By the time any manager is dealing with an issue coming from the bottom up, you’re scrambling to contain a rapidly spreading fire and very real business risk.

Fair and equitable compensation is one of a greater group of decisions that executives have to make as their business interacts with different stakeholders, be it employees, suppliers, local residents, regulators, and government bodies. These topics concern how a business handles social criteria (e.g. gender and race) as well as governance (e.g. board voting, compensation, etc.). In our previous piece, we dissected climate (the E in ESG), but now turn our attention to S and G programs because companies just like Tyler’s are looking to better manage these matters—and are also running into significant challenges doing so.

S&G in ESG encompasses:

Social criteria which examine how one manages relationships with employees, suppliers, customers, and the communities where it operates

And Governance, which deals with a company’s leadership, executive pay, audits, internal controls, and shareholder rights

Shifts in sociocultural expectations—as well as increasing regulatory, employee, and customer scrutiny—are driving the need for tools and platforms that can help organizations systematically address S&G related issues. In the last few years alone, headlines have been stacked with companies making substantial changes to their organizations in the wake of the MeToo Movement, Black Lives Matter, the Equal Pay movement, and others.

In addition to these macro factors, employees have much more visibility into their employers’ practices, which makes it more likely Tyler and other leaders will see more issues surfacing. This is not to say employee transparency should be avoided; employees increasingly value transparency from their employers (and transparency has become standard hiring criteria), but that means companies must proactively manage and communicate their ESG policies with the broader world to ensure it doesn’t result in greater risks to the business.

We tapped some of the top leaders building in social and governance and asked what innovation they thought is positioned to help companies gain the most control over their social and corporate governance programming in the next 10 years. Here’s what they had to say:

“Algorithmic and enforceable. Corporate governance for interacting between employees in a fair and unbiased way. Focus on developing systems that create positive feedback loops and incentives for following rules and standards that are set for how a company holds itself, i.e. its good will and public image.”

—Anish Parikh, CEO of Honcho

“The biggest innovation I see coming in the governance space is the adoption of AI technologies paired with big data to illuminate best practices, establish industry benchmarks as well as automate many routine governance activities.”

— Jeb Banner, CEO of Boardable

“A platform to enable the frontline to: (A.) Establish culture of ESG at an “every employee” level (B.) Allow employees to provide observations on risks and opportunities in real time and (C.) establish clear ESG metrics and celebrate meeting them.”

— Gaurav Kapoor, COO of MetricStream

"Governance comes down to transparency, data, and relationships. Better standards are being created for how companies engage their key stakeholders, and they will be run through a new generation of intelligent software."

—John Melas-Kyriazi, co-founder and CEO of Quaestor

“The foundational measure of an org's responsibility and ethics as an employer: whether it ensures pay equity by gender, race and ethnicity.”

— Maria Colacurico, CEO of Syndio Solutions

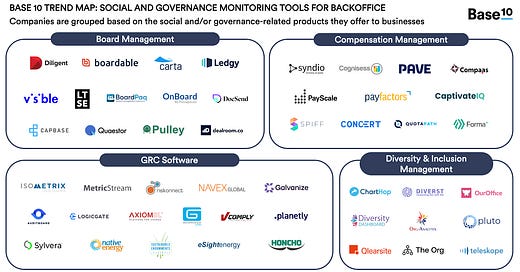

The four broad categories of innovation we're seeing tech companies build in relation to social and governance concerns align strongly with what these experts had to say:

Board management tools that help boards track meetings, collaborate, remediate, and disclose issues

Equal compensation platforms that leverage HRIS data to give people teams and leadership a fulsome view of compensation across their organization

D&I management software that help companies offer more transparency to their employees around the status of diversity & inclusion in varying aspects

And GRC software, primarily from legacy risk management businesses that have added features that help with S&G management

Board management increasingly requires better tooling

Successful ESG policies require leadership buy-in, and so it’s no surprise we are seeing the board—the group with the most power over an organization—increasingly become the focus for ESG technology. We are seeing innovation happening here in many dimensions—from software companies that centralized information and report it to the board, to tools that enable more direct employee communication with the board - and we think it’s a great starting point. Depending on the size of the company, board members range in “closeness” to the actual operations, with some sitting members working with the company (and its leadership) very regularly, while others check-in monthly or quarterly. This varying reporting cadence often results in CEOs oversharing—or under-sharing—critical documents or resources that can lead to confusion during or outside the board meeting.

A typical board doesn’t have tools to collaborate efficiently and effectively as a unit. More and more boards are plagued with endless email threads and unorganized links to Google Drive folders, DocuSign files, and rogue .docx files with minutes from meetings that wrapped months ago. Meeting minutes are a particular pain point given their importance at the board level; these minutes are vital to a board’s success and it’s critical to ensure major decisions, follow-up tasks, and votes are recorded accurately in the event that the company encounters an issue that can be traced back to the board’s decision.

Diligent, which is used by a variety of public companies including General Mills, Dominos, and Barclays, offers a comprehensive environment for board members to access everything they might need before, during, and after board meetings. Diligent was built with SEC mandates in mind, which is something that public companies specifically have to comply with. But we’re seeing more and more private companies take an interest in services like this, especially as they prepare to raise additional capital or IPO.

Boardable is out to solve a phenomenon with boards that the company refers to as “Digital Duct Tape”—a stack of disparate tools that make it difficult to stay organized and connected to the organization at large. Non-profits have a particular challenge when it comes to board management because nonprofit board members outnumber actual non-profit staff 5 to 1 on average. (Disclosure: Base10 is an investor in Boardable).

How software can help ensure equal pay for equal work

While boards are usually responsible for C-level compensation, compensation elsewhere in the organization can be incredibly complicated when factoring in things like sales-based compensation, bonuses, stock-based compensation, and vesting schedules.

In the past, if an executive like Tyler was searching for data on his employees’ compensation, he or someone from his HR department would have to manually pull this information from their HRIS system and build a report analyzing this information. But as total compensation complexity increases and companies expand hiring, we are seeing a transition from this manual process to platforms that automate these data pulls and update the reports in real time.

Companies like Syndio and Pave analyze HRIS data to enable leadership teams to understand how their employees are being paid and to ensure that comparable employees are being paid fairly and equitably. In the past, many organizations have relied on employee surveys to gauge attitudes around equal pay and compensation. Platforms like these would have come in handy when Tyler’s account manager came to him with her concern. He would have been able to pull up his company’s compensation dashboard, easily see her total compensation package, how it’s changed over her employment at the company, and how it compares to her immediate peers. If that data uncovered an issue, Tyler and his team would’ve taken corrective action and been able to look for similar pay discrepancies on other teams and departments. If the platform showed that there wasn’t data to support the disgruntled employee’s claim, Tyler would be able to refocus on this issue’s cultural root and try to understand what would have prompted the employee to come to this conclusion about her pay in the first place.

Players like Pave also enable executives to communicate all aspects of compensation with prospective employees. As companies grow and start offering RSUs, stock options, bonuses, and other methods that contribute to an employee’s total earnings outside of their salary, prospective and existing employees can get discouraged if they don’t fully understand what their whole compensation could look like.

Another key piece of innovation in the compensation space are companies that offer their compensation-related services as APIs so that the pay data and insights can be integrated into the HR workflow. For example, if Tyler’s team brought on a tool like Finch, an API built for payroll and HR, they could unify their recruiting system with their payroll provider to embed compensation management into their offer letters. If the recruiter that was finalizing the offer letter for the account manager we mentioned had comparable salaries available to them in the recruiting platform itself, they would have been able to see that her salary wasn’t at the same level as comparable employees in the organization.

Productizing diversity & inclusion management

Diversity and inclusion is becoming a greater focus for organizations as more research indicates that companies that do not have a strong diversity and inclusion culture ultimately see higher costs from low productivity, high absenteeism, and high employee turnover.

Several emerging startups are offering tools that help employers implement D&I practices across their organization, report on diversity and inclusion issues, and ultimately help companies provide more transparency around D&I to their employees.

HRIS platforms like Workday have made modules dedicated to diversity & inclusion more prevalent in the last year after 2020’s strong focus on the Black Lives Matter movement and improving diversity across all aspects of society. Workday’s dashboard displays workforce data on gender, ethnicity, age, and veteran status. Organization management tools like ChartHop connect to HR and payroll programs to allow companies to build their own D&I dashboards and org charts, giving leadership teams a multi-dimensional view of their headcount that updates in real-time as talent flows in and out. “Chief Diversity Officer” has been touted as the fastest-growing C-suite position, with many companies looking for tools like these to set these D&I-focused leaders up for success.

Legacy players continue to carve out a stake in ESG

The legacy businesses we mentioned in our previous ESG post that are building features to help companies track their carbon impact are also in this space. MetricStream, NAVEX Global, and others have either built tools for companies to stand up and manage a variety of programs that touch S&G or they have dedicated modules that help on governance reporting for these topics.

A number of these tools have a supply chain angle included in their services since many of the rules and regulations that originally started corporate social responsibility and governance evolved from government reporting standards. Back then, companies were getting hammered for bad business practices like sourcing minerals from conflict regions or buying from groups using child labor.

Companies that are leaders in the social and governance concerns of ESG see higher employee satisfaction, higher productivity, and less employee churn, all of which underscore why S&G are critical to an organization’s overarching HR strategy. Tyler’s oversight on compensation management and fair pay could have ultimately resulted in a tremendous risk to his business, which will only grow as his organization grows. This is an area of tech that’s seeing exciting growth and innovation for a number of reasons, and if you are building in the S&G space, we would love to talk to you!

If you’re interested in reading up on ESG, check out our article on how companies are tackling their environmental impact. For a more comprehensive view of the social and governance monitoring tools and players we compiled for this research dive, we also have a visual trend summary that includes a spread of the current players, fundraising history, and active investors.

Base10 is a San Francisco-based early-stage venture firm investing in Automation for the Real Economy. Founded by Adeyemi Ajao and TJ Nahigian, the firm invests in technology companies that are bringing automation to sectors of the Real Economy, including industrial logistics, consumer logistics, restaurants, financial services, and sales & customer service. Portfolio companies include The Pill Club, Virtual Kitchen Company, Acquire, Popmenu, and others.

Subscribe to Base10: Automation for the Real Economy and get full access to our research into various trends that are automating Real Economy industries, as well as companies that are building solutions to real world problems affecting the 99%.