Accessible, Affordable, Acceptable: How COVID-19 Has Shaped Mental Health Care

COVID-19 has opened up untapped care channels for a variety of Americans seeking mental health treatment.

Welcome to issue #2 of Base10: Automation for the Real Economy. Similar to our Forbes articles, each issue will explore our insights into a trend that is automating a Real Economy industry, as well as highlight companies that are building solutions to real world problems affecting the 99%. Today TJ Nahigian and Chris Zeoli discuss our insights into mental health tools for the healthcare industry and our research takeaways:

It’s becoming clear that an early derivative of COVID-19 is a worsening mental health epidemic

COVID did, however, produce regulatory change that ultimately expanded telehealth adoption and broadened insurance coverage for mental health services via telehealth

Demand for mental health tools and services has increased dramatically from both consumers and enterprises

This demand led to never-before-seen investment volume in the space, transforming the landscape and creating opportunities for new tech-enabled services to grow rapidly

A comprehensive, visual summary of the research Base10 has done on mental health tools for the healthcare industry is available on this research page.

2020 was tough on mental health—from wildfires to political unrest, all major events were overshadowed by a raging pandemic that forced businesses to close, hard-working people to lose their jobs, and virtually everyone to hunker down at home. Unfortunately, increased social isolation is only half of the battle when it comes to mental health during a pandemic; anxiety and other mental health issues are all on the rise in the wake of record unemployment numbers and businesses closing.

Consider the case of someone like Ana, a now-unemployed mom that spends her quarantine days juggling housework and keeping her kids on track for their online school. Nearly a year of around-the-clock childcare and the added stress of unemployment have caused Ana’s anxiety to spike—anxiety she sought care for in the past but struggled to find.

To make matters worse, Ana is a native Spanish speaker and could never find a therapist that accepted ESL patients. She lost her health insurance when she lost her job, so options for Spanish-speaking therapists in her area that accept her government-provided healthcare are nearly nonexistent. Instead, Ana prioritizes her kids and a stack of what feels like futile job applications, putting her mental health on the back burner. Like many current and previous mental health patients, the COVID pandemic exacerbated Ana’s preexisting conditions and put her in a lose-lose situation with no clear path out.

COVID dramatically changed the business of mental health, where most visits were previously done in person at clinics with therapists 1:1. Fortunately, telehealth coupled with improved insurance reimbursement has resulted in the mental health market’s exponential growth. A variety of tech and tech-enabled companies are emerging to support an influx of people seeking care, just like Ana, find the help they need.

Where mental health has been—and where it could be going

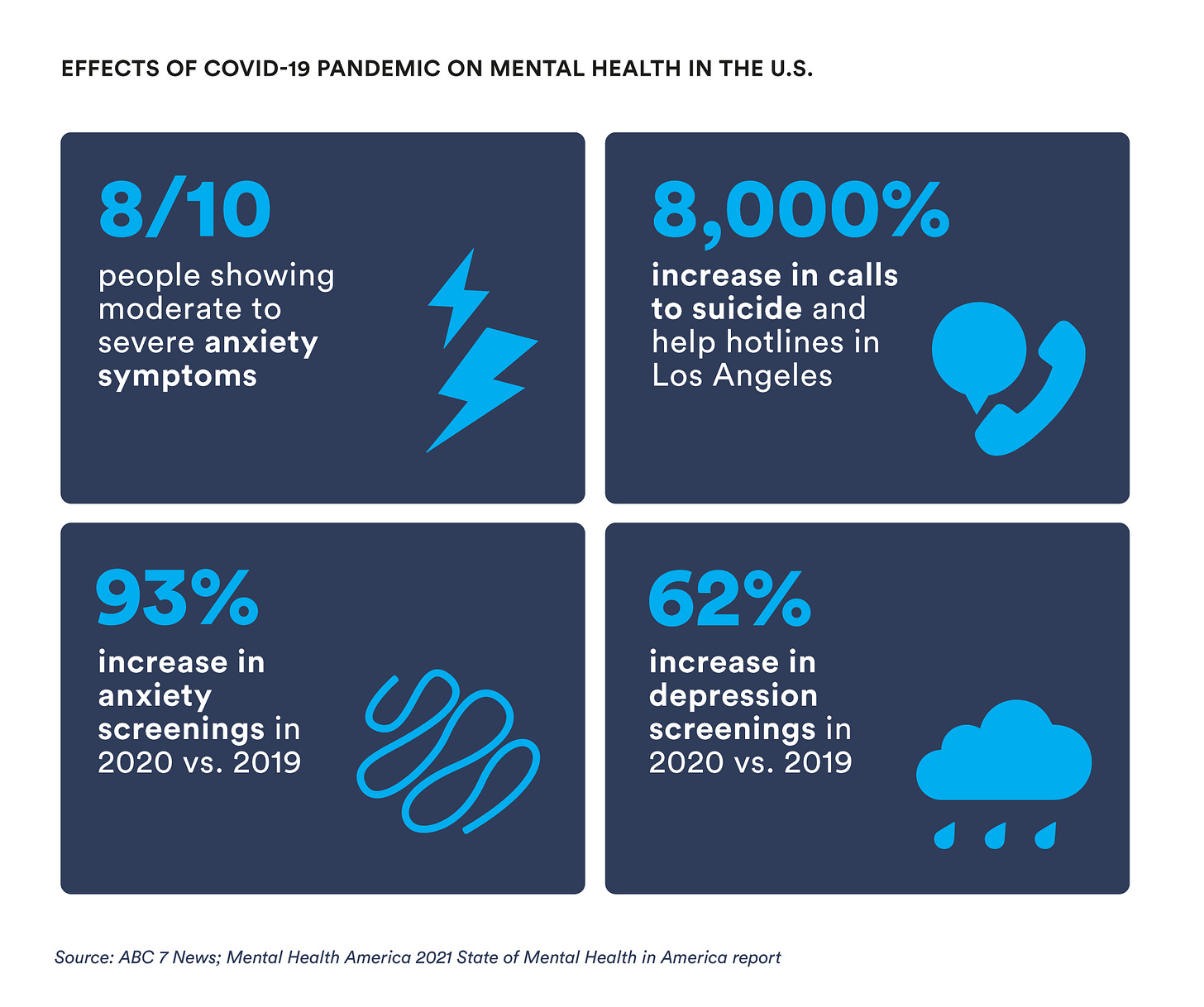

Mental health has traditionally been a stigmatized form of healthcare and the need for treatment has only grown in America. In 2017, according to the CDC, suicide was the second leading cause of death for Americans ages 10 to 24. The rise in suicides and drug overdoses have contributed to a tragic three-year decline in U.S. life expectancy—the longest decline in a century. With the added stress of the pandemic, the rate of moderate to severe anxiety has skyrocketed, with 8 in 10 people reportedly showing symptoms, according to one study.

After COVID-19, mental health challenges spiked with compounding effects from social isolation, devastating unemployment, and political unrest. In Los Angeles alone, calls to suicide and help hotlines increased a startling 8,000% in the wake of COVID-19 related shutdowns. Evolutionary psychologists at the University of Oxford have pointed out that physical touch has a physiological association with lowered levels of stress and anxiety. But touch is something we’re all missing out on; its absence has only worsened the pain of isolation.

Other aspects of mental health such as addiction for opioids or alcohol have gone untreated since they carry a heavy cultural stigma. Close to 90 million Americans have used pain relievers in the past year and 10 million self-report opioid misuse every year. The challenges of both mental health and substance addiction are both widely underestimated since it is often difficult for people to even realize they are struggling with addiction or mental health problems.

The barriers to getting treatment are numerous, and addiction treatment has traditionally required in-person screenings. This contingency drastically limited the potential audience for receiving support since many opioid addiction patients prefer to receive treatment via telehealth. Bicycle Health is an addiction treatment platform that offers evidence-based, online treatment options that typically see the lowest relapse rates among patients. Founder and CEO Ankit Gupta noted, "We saw a 10x increase in demand for our service in 2020, along with an increase in underinsured and uninsured patients. Since our model is centered around digital treatment and telehealth, we're able to provide high quality care that maximizes patient privacy and affordability." Similarly, Ria Health has also seen demand skyrocket for its alcohol addiction treatment platform running via telehealth—providing a new platform where patients can seek treatment in a confidential manner.

The opportunity for startups in facilitating mental health treatment

In many ways, COVID-19 accelerated new channels of treatment, opening up mental health and addiction care to audiences that were underutilizing this segment of healthcare technology. For a more comprehensive view of the mental health tools and players in the healthcare industry, we put together this visual trend summary that includes a spread of the current players, fundraising history, and active investors.

Telehealth was a huge focus in the healthcare industry in 2020, but there remains a lack of strong telehealth infrastructure to power patient-provider visits. Companies like Teladoc and Livongo accelerated revenue growth from around 40% to over 100% YoY. Due to pandemic concerns and restrictions, companies that previously offered both in-person and telehealth options for mental health treatment saw telehealth grow from ~2% of total visits to 100% of visits overnight.

Stephen Hays, mental health-focused investor and founder of What If Ventures, told us, “COVID forced a shift in the market to mostly remote care in a lot of cases. I'm seeing that a lot of these customers at various companies of ours actually want to get back to seeing their therapists and psychiatrists in person, but not always. Based on what I'm seeing, COVID drove a necessary shift in the perception of remote care, but also has underscored the need for human to human interaction when it comes to mental health care as well. I believe the winners in this space will do both remote and in person care well or partner with providers that give them the ability to both.”

Telehealth means patients like Ana can finally enjoy therapy and other mental health treatment from the comfort of their own homes, especially during COVID. With telehealth, there’s no more trying to find time to drive to the doctor’s office, no more worrying about running into someone you know in the waiting room. Despite the prevalence of mental health diagnoses in the U.S., people continue to be hyper-aware of the stigma around seeking treatment, which means people like Ana avoid in-person treatment altogether. For Ana specifically, care always felt like it was made for someone else, uncomfortable with the fact that she could never find a provider that would support Spanish-only sessions. Telehealth removes these barriers significantly, giving people a wider number of care providers to choose from and the convenience of at-home visits to schedule on their own time.

OnCall Health is on the cusp of telehealth innovation in healthcare, offering virtual care software to healthcare providers, including those that specialize in mental health. OnCall enables these healthcare enterprises to rapidly launch virtual care platforms that align with their unique brands and workflows. The company’s offering has become mission-critical for medical professionals amid the COVID-19 pandemic, which has been especially troublesome for patients who were regularly getting in-person mental health treatment (Disclosure: Base10 is an investor in OnCall Health).

We’ve also seen innovation in the mental health space come in the form of insurance reimbursement. Insurance firms have increased coverage for mental health in recent years, with the realization that when left untreated, mental illnesses can potentiate physical illnesses, such as heart disease. Mental illness can thus result in even more expensive care down the road, with depressed patients specifically having an increased risk of other major chronic illnesses like diabetes and stroke. On the topic of health insurance, investor Nikhil Basu Trivedi noted, “Demand for care outstrips supply, and many patients also end up paying out-of-pocket for mental healthcare. Far too few treatments are covered by insurance today, and that must change if we are to address this crisis. Regulation and policy can also help expand access, such as recent changes to telemedicine laws.”

Therapists have also received more support from companies solving insurance-related challenges. In the past, the majority of therapists operated independent practices that accepted limited insurance plans—or no insurance altogether. Insurance practices in the U.S. place many mental health professionals in a deadlock between offering high quality care and accepting insurance plans. Reimbursements for providers are generally low, so psychiatrists were forced to see as many patients as possible for their practices to remain afloat, which means each patient gets less time with their provider.

Companies like Frame are emerging to help providers power their private practices by connecting them with patients. Frame launched last year and now has hundreds of therapists on the platform, making it simple for people to find providers that accept their insurance—all online.

Therapy platforms are some of the fastest growing companies in the mental health space, but Frame is particularly interesting since it offers something we don’t typically see in mental health platforms or software—products that patients actually want to use. According to Frame’s own CEO Kendall Bird, “Therapists go through years of education but are rarely supported in learning about marketing, business development, accounting, budgeting, and so on. Frame has developed a software solution that allows providers to build their own businesses by giving them necessary calendar and scheduling tools, payment processing tools, HIPAA compliant video conferencing, and marketing support. Services like Frame empower therapists to be successful small business owners, saving them time so they can focus on what matters most—their clients.”

We expect to see telehealth continue to skyrocket this year, especially given the recent administration’s broadening of Medicare reimbursements for telehealth appointments. According to the Centers for Medicare and Medicaid Services, 94% of Medicare Advantage plans will offer a telehealth benefit in 2021, compared to 58% in 2020. That means someone like Ana, newly unemployed and on Medicaid, will have more affordable digital options to seek mental health treatment than ever before.

The future of tech-enabled mental health services

The mental health space is experiencing exponential growth, both on consumer and enterprise fronts, enabled in large part to telehealth. The B2B employer-led go-to-market channel (i.e. employers offering third-party mental health platforms and services to employees as a function of HR) is particularly compelling given the success startups in this sector have recently seen. Lyra Health gained unicorn status last August after a $110M Series D, closing another $187M round just five months later. Lyra provides mental health benefits for over 1.5 million working Americans, and it is in good company with Ginger and Modern Health—therapy platforms that also raised Series Ds and Cs in 2020 respectively.

Jamin Ball, Partner at Altimeter Capital and investor in several digital health companies, noted, “Mental health has quickly become a top priority for employers over the last few years, and this trend was well in motion prior to COVID. However, access to care is incredibly supply constrained and the costs can be astronomical for out-of-network care. As consumer comfort around alternative care delivery models like telemedicine and virtual care has increased, digital-native companies like Lyra Health and Modern Health have emerged as leaders that provide a solution that consumers love.”

We believe that platforms focusing on destigmatizing care will ultimately come out on top after seeing increased patient retention. De-stigmatization is particularly compelling in the B2B distribution model since this model allows platforms to reach more patients (that are already insured through their employers) than they would be able to if they went to patients directly. This distribution channel could also prove to open up mental health treatment to groups that have been historically neglected by mental health-focused care.

There remains a huge opportunity for platforms that address alcohol and opioid addictions, as well as those that focus on delivering care to underrepresented groups including minority communities and women. People like Ana, with specific needs when it comes to treatment, still deserve care, and there’s clear opportunities for businesses to come in and capture these patients. Platforms that can prioritize insurance acceptance to ensure groups like these get the care they need will inevitably see strong traction in the market.

We’re excited to see what players come out on top as the stigma around mental health treatment lifts and more Americans gain access to the help they need.

Base10 is a San Francisco-based early-stage venture firm investing in Automation for the Real Economy. Founded by Adeyemi Ajao and TJ Nahigian, the firm invests in technology companies that are bringing automation to sectors of the Real Economy, including industrial logistics, consumer logistics, restaurants, financial services, and sales & customer service. Portfolio companies include The Pill Club, Virtual Kitchen Company, Acquire, Popmenu, and others.

Subscribe to Base10: Automation for the Real Economy and get full access to our research into various trends that are automating Real Economy industries, as well as companies that are building solutions to real world problems affecting the 99%.