The Rise of New Software Ecosystems

SaaS companies are leveraging ecosystems to extend their platforms' value—and entrepreneurs are racing to build businesses and capture a segment of the value these ecosystems are creating.

Over the last 20 years, some of the largest and most successful software companies have successfully built ecosystems around themselves that support and grow their value. We have seen these ecosystems evolve in many forms, but at their core, they enable participants to extend the host platform’s value to end customers, other ecosystem participants, and of course, to the host platform itself. These ecosystems can take many shapes:

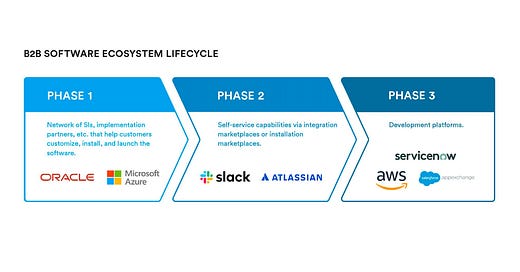

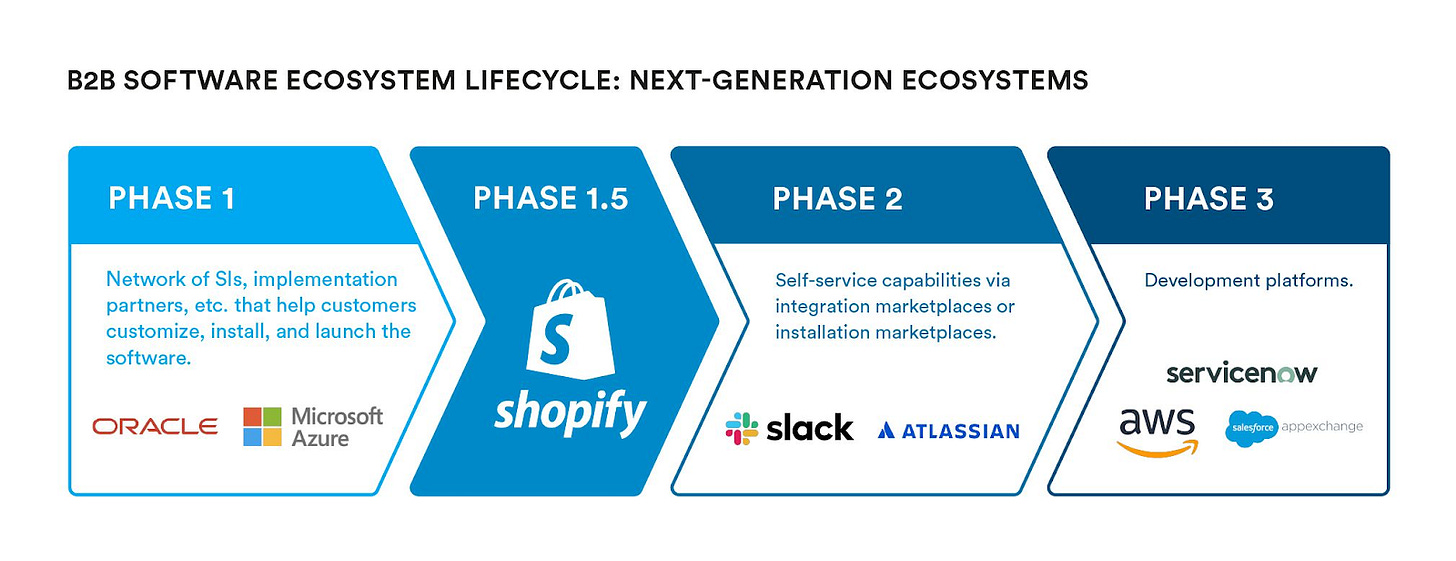

Some evolve to develop a network of system integrators, implementation specialists, or other partners who help end customers customize and implement the host software platform

Others launch app directories or integration marketplaces to help end customers, SIs, partners, and other ecosystem participants connect the host software to other solutions, enabling ecosystem participants to benefit from the host’s install base, demand generation, and marketing activities

And in some rare cases, the host platform evolves into a development platform of its own, so new solutions—some may be tailored to a specific vertical, others to a specific workflow or process—can be built on top of the host platform

At Base10, we summarize the three components of how ecosystems evolve into phases: phase 1 is predominantly focused on selling (and supporting) the host platform; phase 2 is focused on leveraging the marketing of the host platform to grow the ecosystem; and phase 3 is focused on enabling others to build on top of the host platform.

When these ecosystems emerge, something really special is happening. The software companies that reach phase 3 tend to be the biggest, most significant players in their market, and they can leverage the ecosystem as a competitive moat. In Phase 3, the platform itself ends up resembling an operating system. In the same way the existence of iOS means you have the ability to build an app-first product like Uber, you can build apps on top of these developer platforms, which presents a greenfield of opportunities for founders as well as investors.

Case Study in Ecosystem Evolution: Salesforce

In modern SaaS history, the canonical ecosystem example is Salesforce, which launched Force.com (now branded as Salesforce Platform), its development platform for others to build software leveraging Salesforce’s infrastructure, in 2007. Building on top of Salesforce Platform has a number of benefits:

It reduces the time required to launch a cloud app with a customer by not having to build and manage all that technical infrastructure

You can bypass security reviews because you are using Salesforce’s infrastructure, so companies can more easily sell bigger deals,

You can sell internationally immediately by leveraging Salesforce’s internationalization services

The success of Salesforce Platform is striking, and the value it has driven to the ecosystem is impressive. Salesforce has built one of the largest partner bases in the world, with partner revenue reaching an estimated annual run rate of $26B in Q1 of 2022:

That’s just the direct value of Phase 1 of Salesforce’s ecosystem. Salesforce drives a lot of business for its partners too, and that highlights how valuable Phase 2 of Salesforce’s ecosystem is. Partners like Zoominfo (as of today, a ~$15B market cap company) publicly report that 32% of their customers use their Salesforce integration. The AppExchange, where a lot of Phase 2 value is built, continues to be a remarkable asset. By our count over 10 million installs have been facilitated via theAppExchange. Just over the last year, Salesforce customers installed over 3,000 apps per day, and there are now over 4,000 apps listed on the AppExchange.

The growth of the AppExchange is impressive, and it is showing early signs of re-accelerating at scale.

But the most impressive data point to us about the evolution of Salesforce’s ecosystem is how much value Phase 3 is driving to the ecosystem. By our count, Salesforce Platform has produced ~10 meaningful software companies—businesses built on top of the Salesforce infrastructure—and a number of multi-billion dollar outcomes:

What does the development of Force.com tell us about the outcomes other ecosystems can support?

At Base10, we believe there are other ecosystems that are starting to resemble the early days of the Force.com ecosystem and are working their way through the respective stages of the ecosystem lifecycle:

By using the history of ecosystems as a reference, we’ve built a way to estimate, based on an ecosystem's scale and growth—things like partner revenue, development platform scale, developer adoption and other factors—how many scale outcomes of new businesses can be built on top of that ecosystem. You can think of this analysis as: “Given an ecosystem’s size, how many unicorns can it support?”:

Through this lens, we can see that although today the Salesforce ecosystem can support +/- 10 meaningful outcomes, as its ecosystem grows, it can support double or triple that amount in the next decade. That’s really powerful!

The Next Great Ecosystem: ServiceNow

When we look towards other ecosystems, we can’t help but hone in on the ServiceNow ecosystem. ServiceNow is really interesting because it’s evolving into a development platform—reaching phase 3—and its app store is gaining adoption. We see really interesting opportunities to invest in this ecosystem because today, it can support a few billion dollar outcomes and—in the future—will look like the next Force.com

A key indicator of this opportunity for ServiceNow are the new businesses we’re seeing being built on the ServiceNow platform. In 2015, ServiceNow officially launched its CreateNow Developer Program to encourage customers and partners to build their own applications and integrations on ServiceNow. With this launch came the ServiceNow Store, the official app marketplace that developers could then use to market directly to companies that were already ServiceNow customers.

In 2021, ServiceNow partner revenue reached an estimated $1 - $1.5B. Given the outcomes we’ve seen in Phase 3 of maturity, this is enough scale to support an ecosystem with a $500M EV business. But, based on its current growth, we estimate annual partner revenue for ServiceNow will reach $10B in the next 5 to 10 years, and at this scale, we’d expect to see multiple unicorn outcomes within the ecosystem.

ServiceNow remains largely a blue ocean opportunity for entrepreneurs looking to unlock the potential of the ServiceNow platform itself to create differentiated and powerful apps and businesses. We are very much excited to see what comes out of the ServiceNow ecosystem, but also the opportunities emerging across other platforms early in their ecosystem maturity. Stay up to date on this ecosystem research via base10.vc, as we plan to publish more work analyzing other ecosystems as well.